Aoifinn Devitt, Chief Global Market Strategist

Maybe it is because it is an election year, but we still have China on our minds. Despite the fact that China continues its decline on the global market stage, its policies cast a long shadow. When looked at as a percentage of the Emerging Market index – China peaked at 43.2% in October 2020, and has fallen to around between 23 and 26%, a record low, and reflecting the $4 trillion in value that has been lost in that stock market since 2021. However, the shadow is in the form of an influence on sales figures by mega-tech stocks as well as a chilling effect that the impact of reduced Chinese government stimulus can have – e.g. the recent target of growth at around 5% is somewhat muted relative to past expectations. It does seem that a lot of investor mood is “Made in China”.

The picture across the Yellow Sea in Japan could not be more of a contrast. As inflation has finally reared its head – to a 41 year high of 3.5%, the stock market has followed suit and has breached the notable 40,000 level on the Nikkei 225, eclipsing the 1989 peak. Given that similar demographic issues grip both markets (the average age of the Japanese population is now 50), this split in fortunes is a little baffling.

The other shadow is cast by demand from the East – the massive run up in Gold and Bitcoin prices over recent weeks – both have hit record highs – is speculated to be driven by demand from the Asian region. These two indicators certainly evidence a strong demand for speculative assets as well as traditional hedges (gold).

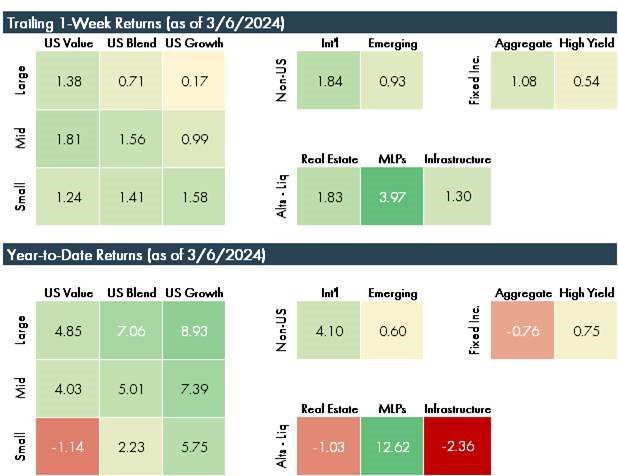

Equity markets have been extremely robust year to date: The S&P 500 pushed records higher eight times in February and climbed 5.2% overall, extending its positive streak to four months in a row, generating a cumulative gain of 21.5% over this period. All 11 sectors were positive last month. Just in recent days there was a spot of weakness given the news around China stimulus and some slackness in US economic data which drove bond yields slightly lower, but affirmation from the Fed that rate cuts would be nigh shored up both sentiment and demand for bonds mid-week.

These numbers were grounded in strong earnings gains for the fourth quarter – as companies in the S&P posted an average earnings gain of 4.0% over the same quarter a year earlier (FactSet). Communication services posted a 45.0% gain, making it again the sector leader in terms of earnings.

With Super Tuesday over and the 2024 Presidential election field feeling a lot like four years ago, we can now expect policy lines to be drawn and election manifestos to take shape. We’ll maintain a weather eye on international winds of change as we look to the forecast of our domestic ones.

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.