Aoifinn Devitt – Chief Global Market Strategist

In recent weeks the Land of the Rising Sun became the Land of the Rising Yen, and then the catalyst for a roller coaster swoon in markets followed by an uplift. As we write, mid-week, we are picking through the noise to see if there is any signal.

As election fever mounts, conventions come and go and the top and second on the Presidential ticket solidify, we are getting used to divisive and bipartisan discourse here in the US. What is less familiar, however, is the bipartisan nature of market takes. Last week we swiftly moved from “soft landing” to “are we on the brink of recession” to “largest fall since Black Monday, 1987” (in the case of the Japanese stock market). We lurched from suggesting the Fed was prudent to remain disciplined on monetary easing to calls for faster and more drastic rate cuts – not just in 25 bps chunks, but in 50 bps cuts – immediately. Markets breathlessly watched the Oracle of Omaha, Warren Buffett, cut his stake in Apple in half and sell over $3.8 bn in Bank of America stock and took it as an “ominous sign” – although it comes at the tail end of Berkshire Hathaway shedding over $56 bn in equities over 18 months. Why the current sale prompted more attention may be coincidental or may indeed signal the top of a market – at least according to the Oracle.

At Moneta we try to steer a middle ground between extreme takes on markets (the other being one of enduring exuberance, perhaps reflected in the swift rally that followed Monday’s swoon). The slow but steady rotation out of momentum stocks that has added breadth to stock markets (read more about the Great Rotation here) over recent weeks, has been a slow shifting of the narrative around the Magnificent Seven stocks and their like. This new narrative includes the entry of a more nuanced view on artificial intelligence (AI) and its use cases, a recognition of lofty valuations in the tech sector (particularly Nvidia), the nagging worry of deteriorating economic indicators like employment and consumer confidence and the steady drumbeat of geopolitical surprises (which we have previously characterized as a “geopolitical recession”). All of this leads to the expectation of rate cuts, which will gradually make bonds (and cash) less attractive, and let bond substitutes return to favor (real estate, industrials, dividend paying stocks are all regarded as bond substitutes). This has already happened to a degree – with the rotation into more defensive stocks referenced above.

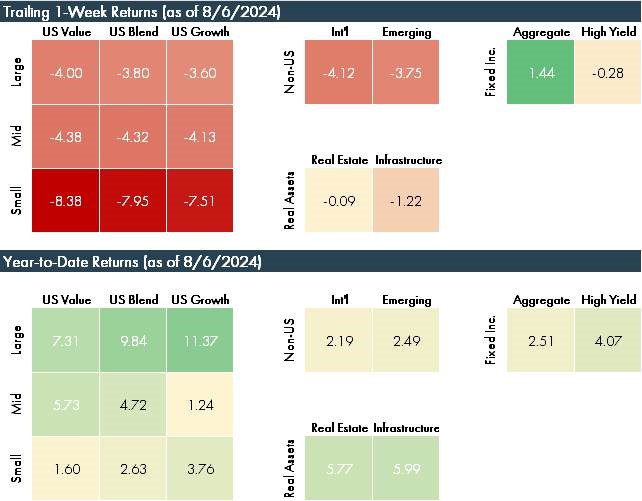

As an example of just how the moves in the past week served to cancel each other out:

So the narrative in markets is more akin to a disciplined unfolding plot than one where the script has been torn up and rewritten. In this election year above all, we should steer clear of extreme hyperbole and maintain the long view.

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.