We sit here on Wednesday, November 6th, with one of the most expensive and dramatic Presidential campaigns behind us. Before we run through the data, results, reaction and implications for the markets, let’s savor a few details: the system worked, election results were emphatic, and we have clarity on leadership for the next four years.

Election Results

As for the results, not since Grover Cleveland in the late 1800s, have we seen a former President reelected for a non-consecutive second term. As we write, Donald Trump is projected to be the 47th US President as he surpassed the 270 electoral votes needed to win the election backed by a popular vote win as well. Battleground states, which were expected to shape the election outcome, were key to Trump’s victory as Wisconsin, North Carolina, Georgia, Michigan and Pennsylvania all went to Trump. The momentum carried forward into the Senate races with Republicans securing 52 seats, giving them majority control of the Senate. A few Senate races remain outstanding which can potentially increase the Republican majority. On the House of Representatives side, Republicans are holding on to a slight majority, but there are several races still being counted which will delay any certainty of the House outcome till later in the week.

Market Initial Rection

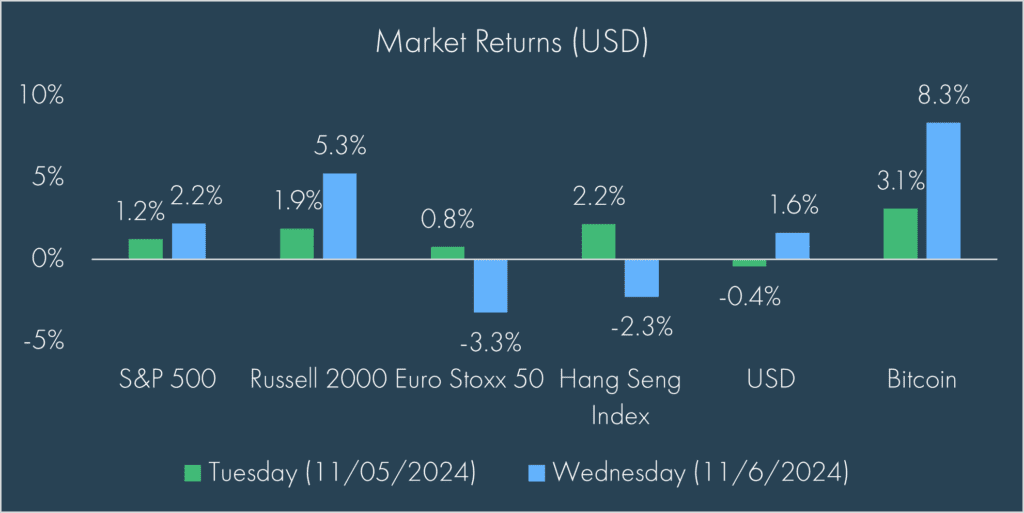

Domestic markets have reacted positively thus far with US equity markets rising as of 12:00PM CST today: S&P 500 +2.2%, NASDAQ +2.7%, and Russell 2000 +5.3%. This reaction aligns with market relief over avoiding a contested election result and expectations for business-friendly moves by the incoming administration. Non-US equity markets are less sanguine given the threat of more protectionism and tariffs in a Trump administration. European and Chinese equities, two regions most attune to US trade policy, fell 3.3% and 2.3% respectively. A US Dollar surge to its highest level since March 2020 is weighing on non-US markets. Cryptocurrencies broadly moved higher on expectations of friendly policies under the Trump administration, with bitcoin hitting new all-time highs.

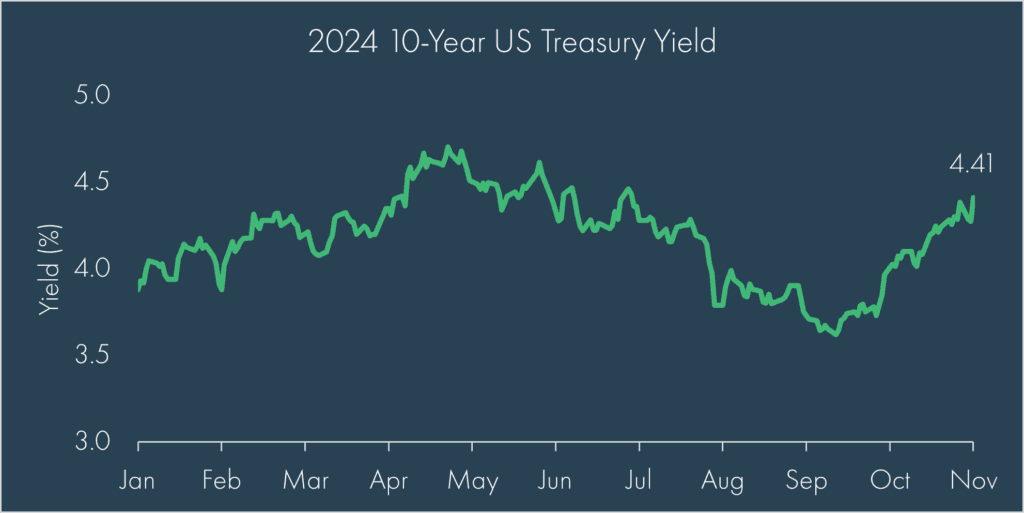

Rate markets are continuing their trend higher with the 10-Year Treasury up to 4.41%; this has been an ongoing trend since mid-September as markets lowered expectations for future Fed easing lower, economic growth showcased continued resilience, and the prospect of a Trump victory increased. The prospect of higher deficits will likely be reflected over the near-term but to be sure, the 10-Year Treasury sits nearly 30 bps lower than its high seen in April of this year.

Potential Implications of Election

While we have argued many a time that there are forces more impactful to markets and the economy than the outcome of elections, government policy does still matter and there could be some early implications to draw from yesterday’s results:

- Fed Policy: The Fed is due to lower rates by 25 bps at tomorrow’s FOMC meeting, a move expected regardless of the election results. Future monetary policy moves could take on a different perspective given expected Trump administration policy. More important though to the Fed is the underlying health and trends in economic policy, labor markets and inflation. Those alone are trending positively, and we expect the Fed to continue to act according to the incoming data.

- Fiscal Policy & Deficits: Fiscal expansion, as seen via increasing debt and widening deficits, has been an ongoing concern for markets and investors. Trump’s proposed policies could increase the deficit, leading to elevated Treasury supply and with it, elevated rates. That said, Trump has spoken to auditing the entirety of government spending which may help the government move toward a more sustainable spending posture. The outcome of the House race could have implications on future fiscal austerity measures.

- Taxes: The pending expiration of tax rates set by the 2017 Tax Cuts and Job Act is certainly top-of-mind for taxpayers, investors and financial planners. However, Trump’s win and the Republican Senate victory make a complete reset to pre-2017 tax policy more unlikely. That said, the fiscal situation and limited Republican Senate majority (at most), or potential minority in the House, may require some compromise with elements of current tax policy.

- Trade Policy: Tariff policies will likely come into sharp focus in 2025 under the Trump administration as it was during his first stint in office. Whether a true threat or just a negotiating tactic, there will be potential winners and losers to enacted tariffs and markets will react accordingly. We will watch closely for any developments that could impact allocation decisions.

Conclusion

Prior to the election, there was no crystal ball for the outcome. Now that we do know the outcome, we have more clarity on the potential paths for the economy and markets, although nothing is guaranteed. What do we know for sure? This economy is in a relatively good place with reasonable rates, strong employment, inflation at acceptable levels and generally positive economic data.

For all the consternation leading up to the Presidential election, one should be careful not to talk oneself out of what has been working the entire year with economic growth sustaining itself and markets rewarding investors. Ultimately, another Presidential election has come and gone. Market makers and traders can sell fear and volatility. They may lure the broad crowd in and make investors take their eyes off the long-term goal. At Moneta, we are long-term investors and see this most recent election as one of many that we’ll experience in our lifetimes. We invest with a plan and a goal. We are driven by data and analysis. We have high quality partners and focus on high quality stocks and fixed income. We use alternatives where it fits the client’s liquidity and risk profile and maintain the belief that simpler is better. It may take a couple of days to get a certified outcome, but in a week or two, it will be back to basics.

Contributors

Andrew Kelsen – Chief Investment Officer

Chris Kamykowski, CFA, CFP® – Head of Investment Strategy and Research

Tim Side, CFA – Investment Strategist

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.

DEFINITIONS

The S&P 500 Index is a free-float capitalization-weighted index of the prices of approximately 500 large-cap common stocks actively traded in the United States.

The Russell 2000® Index is an index of 2000 issues representative of the U.S. small capitalization securities market.

The EURO STOXX 50 Index is an index of 50 blue-chip stocks from 11 Eurozone countries, providing blue-chip representation of super sector leaders in the region.

The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong. The components of the index are divided into four subindices: Commerce and Industry, Finance, Utilities, and Properties. The index was developed with a base level of 100 as of July 31, 1964.

The US Dollar Index measures the US dollar against six global currencies: the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

The 10-Year Yield Treasury yield is the effective annual interest rate that the U.S. government pays on its 10-year debt obligations, expressed as a percentage. Broadly, the Treasury yield is the annual return investors can expect from holding a U.S. government security with a given maturity.