Aoifinn Devitt – Senior Investment Advisor – Family Office

As we digest the moment that a nation has been waiting for – there is one feeling that is universal – certainty. After many cycles of disputed elections, a decisive result brings closure, and US markets are opening Wednesday with a flurry of activity.

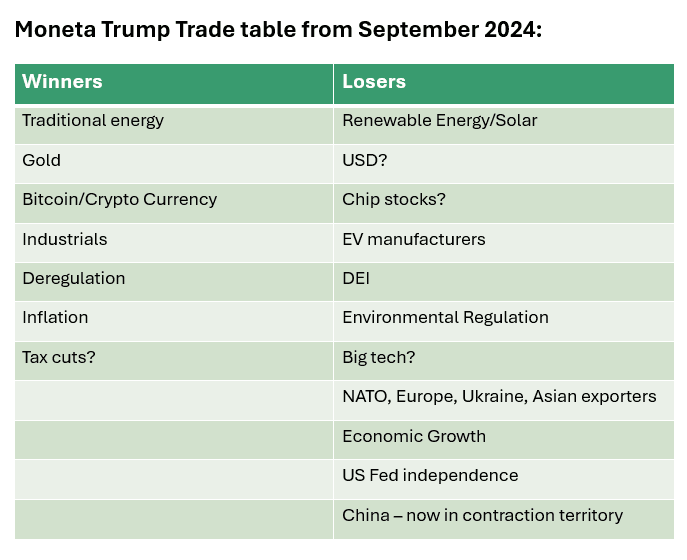

Weeks ago we published a table showing the potential winners and losers in a so-called “Trump trade”. Digging into these numbers a little more – we already have the market’s knee-jerk reaction – and it is broadly tracking those forecasts. Stock markets are indeed moving positively – potential tax cuts, deregulation and the traditional pro-market Republican policies have already sent markets up around 2% this morning. The prospect of new tariffs and an “America first” stance on trade has already had an impact on trading partners such as China and Mexico (and their respective currencies), which are all weaker this morning.

We are often told to heed the bond market, especially when it diverges from the equity market, and the stark rise in the yield of 10-year US treasuries – which, as we write, has risen by almost 20 basis points – its biggest daily gain since September 2022 – suggests concern.

The rise in yields suggests that the market expects more inflation, a rate cycle that is higher for longer and a rising budget deficit.

It is worth recalling that the recent analysis by the Committee for a Responsible Federal Budget had as a central case Trump’s policies adding $7.75 trn to the budget deficit, driven by tax cuts and offset largely by tariff revenue and cost cutting. A rising budget deficit tends to undermine faith in fiat currency and could bode well for alternative assets such as gold and Bitcoin (already boosted by a pro-cryptocurrency stance in Trump’s policies and currently around $75,000).

The market reactions are following projections largely as the election results followed the poll predictions, and despite a tremendous amount of noise, the “surprise” component is muted this morning. Clearly there is some space between today and the implementation of Trump 2.0, and the detail of implementation may muddy some outcomes – for example, will tariffs immediately translate into inflation or will there be lags, and will tax cuts offset some price rises? The US Fed is set to meet this week, and will they find the data they seek to introduce a further 25 bps rate cut as broadly expected?

Portfolios are likely to be buoyed by today’s developments, and in the medium term we note that equities, real estate and real assets are generally considered to be assets that provide “inflation participation”. The world is changing, and a more protectionist trade stance and geo-political posture will change the landscape for US trading partners and the US dollar. We will digest this nuance and ask it merits a re-underwriting of traditional diversification norms. We will observe the direction of the US dollar to confirm if policies are supportive or not – if not, then diversification by currency will continue to make sense.

We are on the cusp of a new chapter of policy change and market reactions. Watch this space for analysis at each stage.

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.