The Johnson Team

We build trusted relationships with our clients via proactive service and advice as we counsel them through life’s decisions. We embrace our collective expertise as a team, empowering each other as we work towards common goals.

About Us

If the Johnson Team at Moneta promises something in one week, we like to deliver in one day. This lets you know that we are actively involved and ready to address any situation that comes your way. The depth and breadth of our service makes us unlike other advisory teams in the industry.

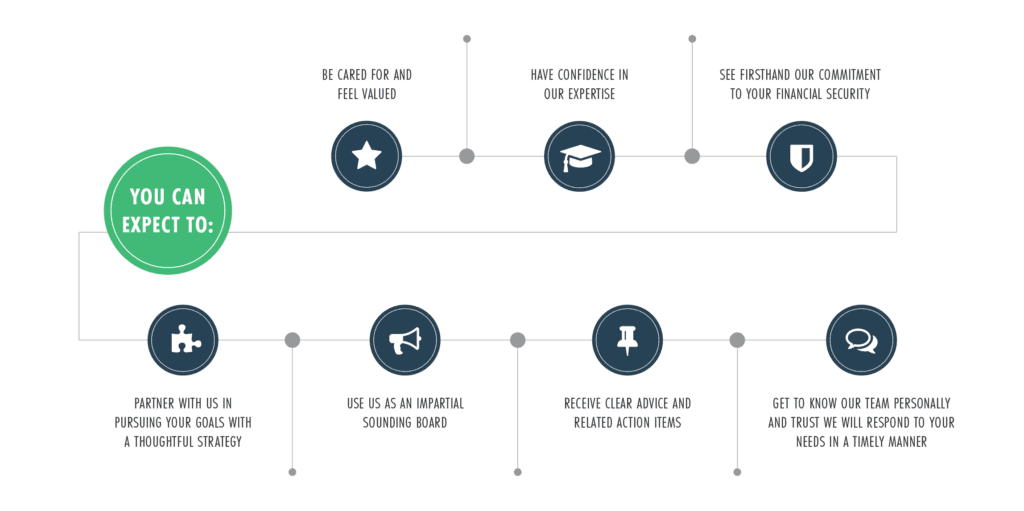

While we guide you through your unique financial situations, you can expect to:

Our Team Values

Client First

Our service and advice is always personal and highly customized to your specific needs and goals.

Communication

Every interaction is a journey toward trust. We communicate with consistency and clarity, after listening and with respect.

Team Approach

We serve you better together as a team, leveraging our collective expertise to deliver a comprehensive financial action plan and client experience.

Enthusiasm

We are passionate about helping you navigate life’s path while protecting what you cherish as Your Family CFO. We are emotionally invested in your success.

Services

Retirement Planning

There is no such thing as a standard-issue retirement. Your vision of retirement comes from a unique blend of your own personal goals and priorities for when you retire, where you retire, what you do and how you live after you retire. All of this can of course change overnight when life throws unexpected circumstances at you regarding healthcare and family dynamics. As your Family CFO, we help you plan for the retirement you want while protecting against the unknown variables.

Tax Consulting

Our team brings the education and credentials necessary to accurately interpret and communicate changes to the tax law. We do the complicated and time-consuming work of keeping up with all the latest legal nuances so we can continually help you optimize your wealth strategies accordingly.

Investment Management

Your personal investment strategy should be based on your own personal situation, goals and risk tolerance. We can help customize an asset allocation that is best for you specifically and then proactively monitor your investment portfolio so that it continues to meet your changing needs.

Education Planning

Paying for a child’s education is one of the most common major expenses weighing on a parent’s mind because it is so important and so expensive. As Your Family CFO, we empower you to take care of your loved ones through every stage of life.

Estate Planning

Whether you need basic security for a young family, a sophisticated solution to complex tax challenges or a comprehensive vision that encompasses multiple generations, we have estate planning specialists on hand to consult you through the optimal approach for each situation.

Insurance Analysis

One of the most important ways to protect yourself and your family is through insurance. Choosing the type of coverage that is most appropriate for your life’s context will help build a strong base of financial security.

Asset Protection

Whether you are an established executive or just experienced a sudden increase in earning power, ensuring you manage your wealth wisely is a priority. Optimizing cash flow and cash positions while minimizing taxes and interest costs requires truly objective, expert advice. As Your Family CFO, we serve as your trusted guide in guarding against risks to your earning potential early on before reorienting investments toward capital preservation and asset protection as you approach financial independence.

Social Security Planning

Determining when to claim your Social Security benefits can significantly impact your life in retirement. Choosing the right strategy here requires careful planning with a holistic look at your entire financial picture. As Your Family CFO, we can help you navigate this decision while taking a comprehensive approach to managing your wealth.

Charitable Giving

We understand that philanthropy means much more than an effective way to reduce taxes. From establishing a family foundation to identifying creative and optimal ways to support your most cherished organizations and causes, we guide you through all the complex details that come with significant charitable endeavors and endowment-level gifting.

Who We Serve

We make sure we gain a deep understanding of our clients through genuine relationships so we can always serve your best interests as true fiduciaries. When it comes to your needs or goals, we are extremely diligent to cover every base, cross every “T” and dot every “I.” That even includes your family’s next generations. Our team features Advisors across several different age brackets and career stages, ensuring we are equipped to sustain our service to you and your loved ones long into the future.

Retirees

Pursuing new challenges, rediscovering old passions or maybe just enjoying life’s simple pleasures – no matter how you envision your life in retirement, we can guide you along the way. Stewarding your wealth, transferring it to the next generation and giving back to your community are all important financial decisions that we have the expertise and experience to navigate with you.

Corporate Executives

The more complicated your financial life is, the more attention it deserves. As a corporate executive, you face unique financial planning challenges while also living in a constant time deficit between work and your personal life. We provide both the expertise to manage the complexities of your wealth and the bandwidth to proactively execute your comprehensive, customized financial plan.

Emerging Affluent

Our team serves individuals and families in every stage of the wealth life cycle – including young high earners on track to building lasting wealth. As your dedicated financial advisor, we take time to gain a deep understanding of your financial trajectory. With this trusted relationship in place, we can then help strategically guide you towards your goals while still accounting for your current needs through a personal, customized approach.

Meet our Team

Cynthia LaFerla

Senior Client Service Manager

Abby Long

Client Service Administrator

Gigi Reedy

Client Service Manager

The Client Journey

Discovery

Mutual learning opportunity to see if we might be the right fit for you.

Financial Action Plan

We will provide you with our comprehensive plan addressing a wide range of financial issues. We will present our recommendations and explain the rationale so you can make informed decisions.

Implementation, Ongoing Review, & Reassessment

Together, we will carry out our recommendations, making adjustments along the way.

Frequently Asked Questions

Why should I hire a Family CFO – can’t I do it myself?

Some people decide to do their own financial planning. It’s easy to feel overwhelmed with understanding the implications of each financial decision you make. We work best when we partner with those that are willing to delegate to our team.

What makes you different form other financial advisors?

Ultimately, we feel our value becomes apparent through the conversations that we have with our clients and catering our services to meet your specific needs. We certainly think we are different, but at the end of the day, that is your determination to make.

Are you a fiduciary?

Yes – As a fiduciary, we are committed to placing your interests above our own and strive to continually reaffirm the trust you place in us.

Do I have to live in St. Louis to work with you?

No – While the majority of our clients have had some sort of tie to St. Louis at one point, we work with several retirees and working professionals around the country.

Is there a fee for an initial meeting with you?

No – Think of our initial meeting as a mutual discovery process. We have no preconceived notions of where the conversation will go.

Should you decide to be a client the fees include comprehensive financial planning in addition to investment advisory services.

A Wealth of Information

DIVE INTO THE LATEST INSIGHTS FROM OUR EXPERT TEAM.

-

Second Quarter Investment Report – 2025

Introduction Much has changed since we ended March on a dour note, with the S&P down nearly 6% that month…

-

Monthly Recap – June 2025

June Observations Second Quarter Ends on a High Note Global equity markets extended their rally into June as continued economic…

-

Geopolitics Update: Monitoring the Recent Escalation in the Middle East

Last week, Israel launched a direct attack on Iran, targeting key military assets including senior leadership, defense systems, and nuclear…

More Resources from Our Team

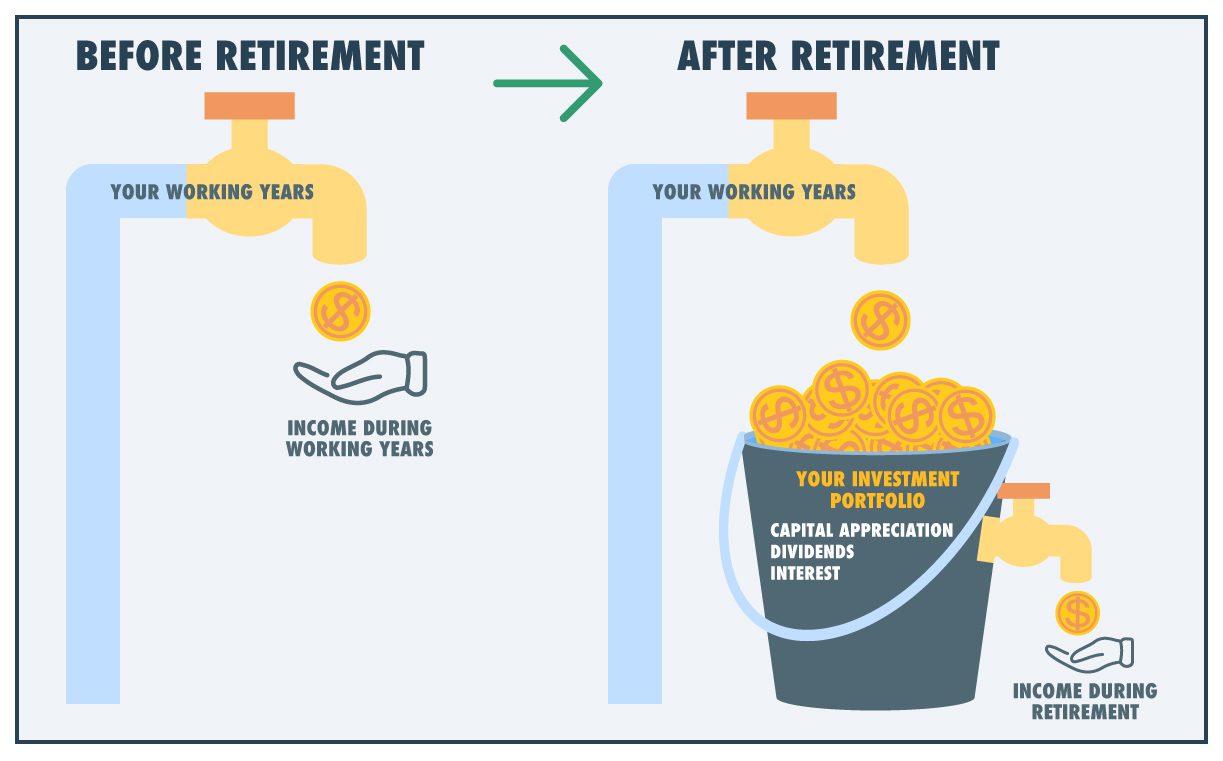

How Do I Replace My Paycheck During Retirement

When you retire, the typical paycheck from your employer stops coming, but your income needs do not necessarily stop coming. Instead, you may start to rely on your investment portfolio…

Substantially Equal Periodic Payment (SEPP) Plans

Substantially Equal Periodic Payment Plans… that is a “mouthful” of a strategy, but the details of such planning don’t have to be complicated…

What is the Right Asset Allocation for You? Consider These 4 Guidelines

This is one of the most important questions each investor has – one we often hear, especially from people worried about any short-term drop in their portfolio’s value during periods of market volatility. Each person has different needs and objectives…