The Bailey Carpenter Hehmeyer Pietroburgo Team

Helping you see the bigger picture.

Who We Serve

Families: Generational Wealth

Transferring wealth from one generation to the next is a complex process that intersects with your unique family dynamics. We can help facilitate family meetings and educate everyone involved while developing an optimal investment strategy for your specific goals. Our firm provides all the resources you’ll need, from estate planning and tax expertise to trust services

Women: Empowered Partners

We are passionate about inspiring and empowering women to take control of their wealth and be equal partners in their financial planning conversations. Be heard and be valued. Once you feel financially empowered, we’ll help you redirect your wealth toward the areas of life you care about most.

Emerging Affluent: Wealth Accumulator

Our team serves individuals and families in every stage of the wealth life cycle – including high earners on track to building lasting wealth. As your dedicated financial advisor, we take time to gain a deep understanding of your financial trajectory. With this trusted relationship in place, we can then help strategically guide you towards your goals while still accounting for your current needs through a personal, customized approach that simplifies your life.

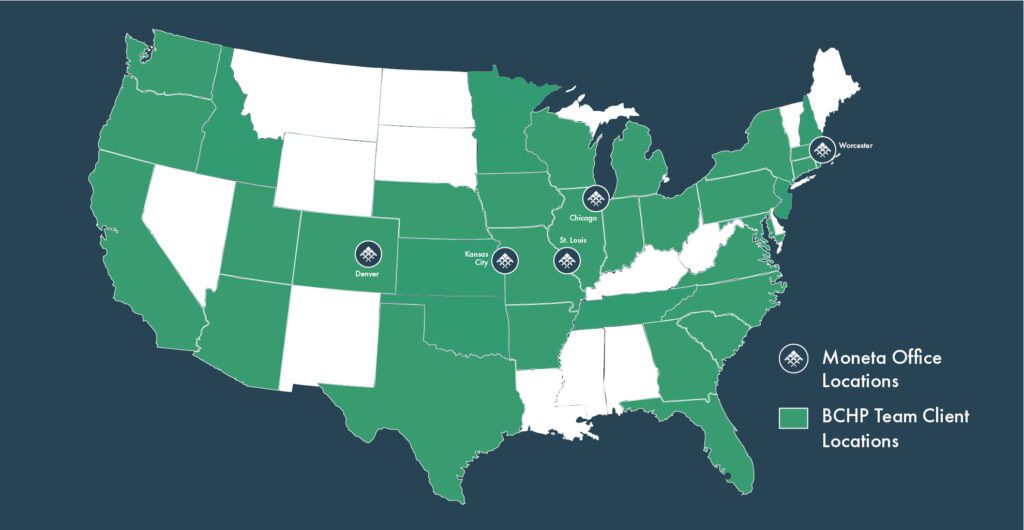

Nationwide Coverage

We are committed to providing highly personal service with a customized approach for each of our clients. This standard of excellence is the driving force behind our firms growing national footprint.

With clients located all over the country, we are establishing a local presence in more cities where they are concentrated so we can serve them better. But this doesn’t mean we are being spread thin. Our staff scales with our size so we can continue serving you proactively and personally. You are our priority, and we are your advantage.

We do more so you can too.

We have been working with wealthy families for 25+ years and understand complex financial lives. Our comprehensive approach is designed to save you time and provide clarity to help you reach your life’s goals.

While we guide you through your unique financial situations, you can expect to:

Be cared for and feel valued.

Have confidence in our expertise.

See firsthand our commitment to your financial security.

Partner with us in pursuing your goals with a thoughtful strategy.

Use us as an impartial sounding board.

Spend less time on financial hassles with more time enjoying life.

Questions you should ask your advisor team:

What is their client-advisor ratio?

This is a measure of how much attention you will receive. At Moneta, we pride ourselves in maintaining a lower client-advisor ratio so we can proactively deliver highly personal service. This also protects our bandwidth for continuing our education so we can continue advising you with the highest expertise.

Who owns their firm?

Does your advisor work and advocate only for you? At Moneta, we pride ourselves on being a 100% partner-owned firm with absolutely no outside shareholders or private equity. This protects our independence and ensures we can stay aligned with your best interest. We don’t sell proprietary financial products or insurance. We transparently provide a clear fee structure.

What happens to you as a client when they retire?

If your advisor doesn’t have a succession plan, they could sell out to a completely different firm. At Moneta, we pride ourselves on designing teams of advisors spanning multiple generations so you never lose continuity of service. Succeeding advisors will begin joining client meetings years ahead of the transition so our clients are always working with someone they know and trust.

Who We Are

Anniece Robinson

Operations Manager

Holly Ausmus

Senior Client Service Manager

Mitchell Faulhaber

Client Service Manager

Jessica Hinkebein

Client Service Manager

John Pohorecki

Client Service Manager

Daniel Prentice

Client Service Manager

Yousef Shabany

Client Service Manager

Ellie Hogrebe

Client Service Administrator

Quin Hoover

Client Service Administrator

Schwab Client Login

A Wealth of Information

DIVE INTO THE LATEST INSIGHTS FROM OUR EXPERT TEAM.

-

A Silver Lining for Your January Gloom

by Tim Side, CFA – Director of Investment Strategy A cruel taste of life in Greenland swept across much of…

-

Fourth Quarter Investment Report – 2025

Executive Summary 2025 served as another reminder of markets’ ability to climb the so-called “Wall of Worry”. The year carried…

-

Monthly Recap – December 2025

December Observations Subdued Month Brings the End to a Solid Year U.S. equity markets closed a robust year in a…