Senior Tax Strategist – Abby Donnellan CPA

The SECURE 2.0 Act of 2022, signed into law on 12/29/2022, builds on the prior SECURE Act of 2019 and focuses on helping Americans save for retirement. Below are some of its key provisions:

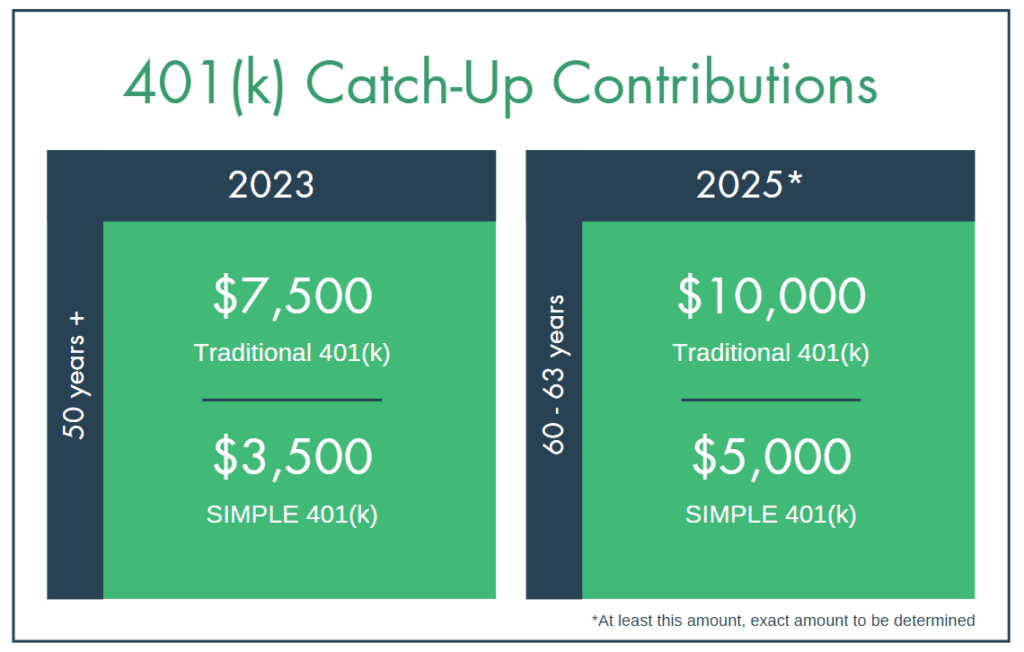

Catch-Up Contributions

In 2023, the catch-up contribution limit for those 50 and older is $7,500 (or $3,500 for SIMPLE plans). Starting in 2025, those ages 60-63 will have an increased catch-up limit of at least $10,000 ($5,000 for SIMPLE), with the exact amount to be announced later.

Roth Contributions

In 2024, individuals making over $145,000 the previous year will have to make catch-up contributions to their 401(k) with post-tax dollars (aka Roth).

Additionally, beginning in 2023, employers (any size) are permitted to match contributions in Roth dollars and can create Roth accounts for SIMPLE and SEP IRAs.

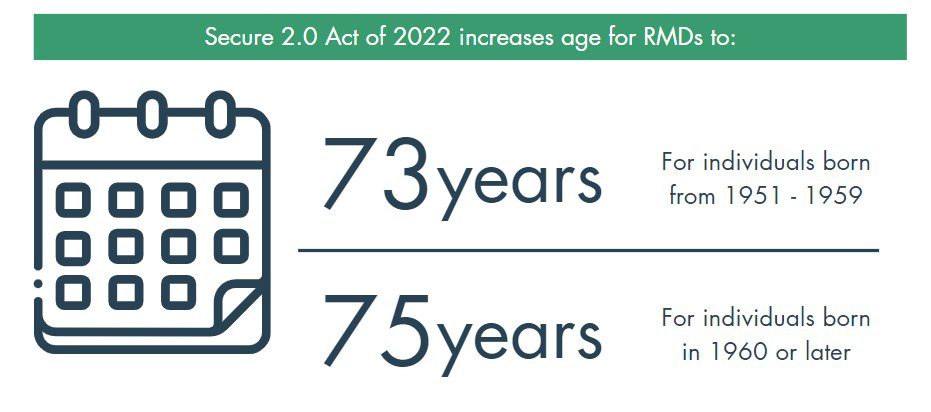

RMDs (Required Minimum Distributions)

Those born 1951-1959 do not have to pull from their retirement accounts until they are age 73 (compared to 72 in prior years). Additionally, for those born in 1960 or later, the age is increased to 75.

Penalties Reduced

Penalties for not taking RMDs were reduced from 50% to 25%. If an individual forgets to take their RMD and subsequently takes it within a reasonable timeframe, the penalty may be reduced to 10%.

Early withdrawal penalties on some funds removed from retirement accounts prior to 59 ½ were also reduced or eliminated for the following:

Starting in 2023

- Individuals in a federally declared disaster area

- Those that are terminally ill

Starting in 2024

- Certain financial emergencies

- Victims of domestic abuse

Starting in 2026

- Certain long-term care insurance premiums

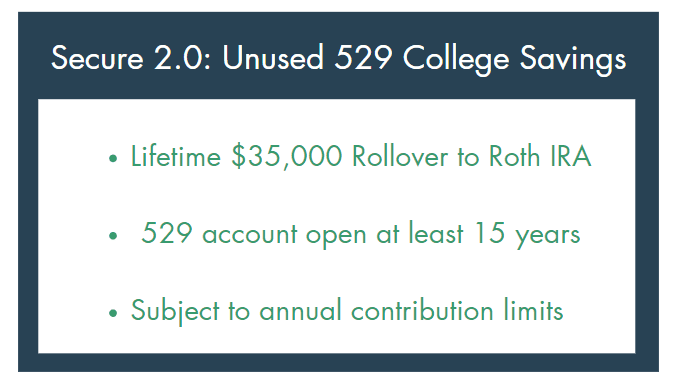

Excess 529 rollovers to Roth IRA

Beginning in 2024, unused 529 plan assets can be moved to a Roth IRA for the 529 plan beneficiary, up to a $35,000 lifetime limit. The plan must have been in place for 15 years, and only funds in the account for 5 years can be moved. The converted funds are also subject to the annual Roth contributions limits (maximum $6,500 in 2023).

Other

In 2023, those over 70.5 can make a one-time QCD (Qualified Charitable Distribution) of up to $50,000 to a Charitable Gift Annuity, Charitable Remainder Unitrust (CRUT) or Charitable Remainder Annuity Trust (CRAT).

In 2024, employers are allowed to make additional employer contributions to SIMPLE plans. In addition, employee elective deferral limits for small companies (less than 26 employees) will be increased by 10%. An employer with 26-100 employees will be permitted to have a higher deferral limit for employees, but only if the employer provides either a 4% matching contribution or 3% employer contribution.

In 2025, retirement plans must be opened to part-time employees who work more than 500 hours for 2 consecutive years.

The SECURE 2.0 Act of 2022 represents a significant advancement in supporting retirement savings for Americans. By increasing catch-up contribution limits for older individuals and expanding opportunities for Roth contributions, the Act encourages individuals to save more effectively for their future. Adjusting the required minimum distribution age requirements gives retirees greater flexibility in managing their retirement accounts. Furthermore, the Act reduces penalties for missed distributions and early withdrawals in certain situations while also introducing provisions to facilitate charitable giving and enhance college savings options. With its comprehensive approach to improving retirement security, the SECURE 2.0 Act of 2022 demonstrates the government’s commitment to empowering individuals and ensuring a stronger financial future for all.

If you’d like to learn more, you can contact me at adonnellan@monetagroup.com

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.