Tim Side, CFA – Investment Strategist

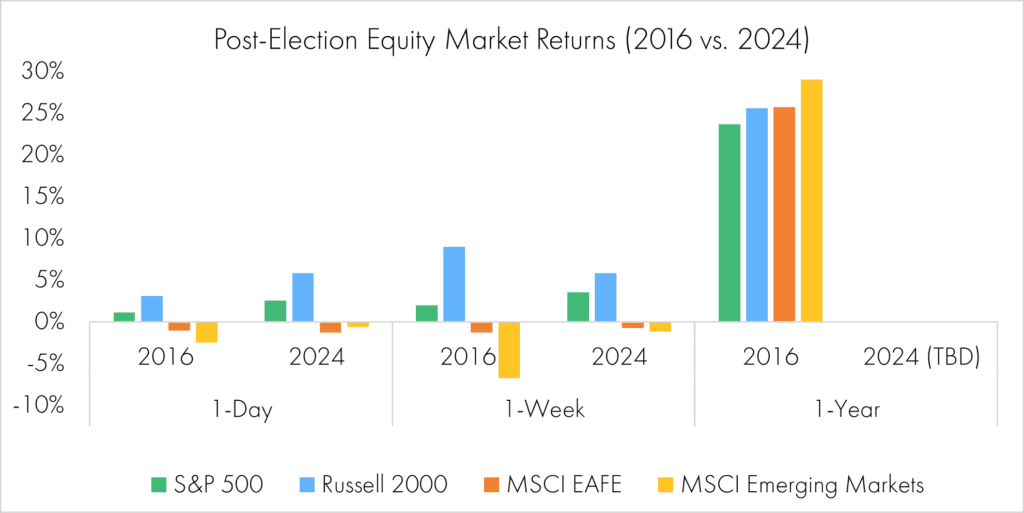

Déjà vu? One week out from the election results and there is an oddly familiar feeling as markets are reacting in a very similar fashion to 2016. Republicans are getting closer to a full sweep of the House, Senate, and Executive Branch, and US markets have responded optimistically:

Looking at the chart above, there are striking similarities between equities’ performance in the early days of 2024 compared to 2016: the S&P 500 Index (large cap) is up, and the Russell 2000 Index (small cap) is up even more. Meanwhile, non-US equities, as measured by the MSCI EAFE Index and MSCI Emerging Markets Index, are both down.

We saw a similar response from the US dollar and US Treasury yields compared to 2016 (dollar stronger and yields higher), though it is notable that compared to the reaction from stocks, the response from the bond markets is exceedingly mild – perhaps aided by a “steady as she goes” message from the Federal Reserve last Thursday and an “as expected” inflation report this morning. Meanwhile, the reaction from cryptocurrencies has been near euphoric, with Bitcoin surpassing $90,000 (up more than 30% since election day) and “accidental crypto movement”[1] Dogecoin up nearly 150% since election day as we write.

No “ink” has been spared by commentators discussing what Trump 2.0 could look like. Each day brings us closer to clarity as cabinet members are announced, but from a markets perspective Trump campaigned on “America first” and markets expect his policies to support that approach.

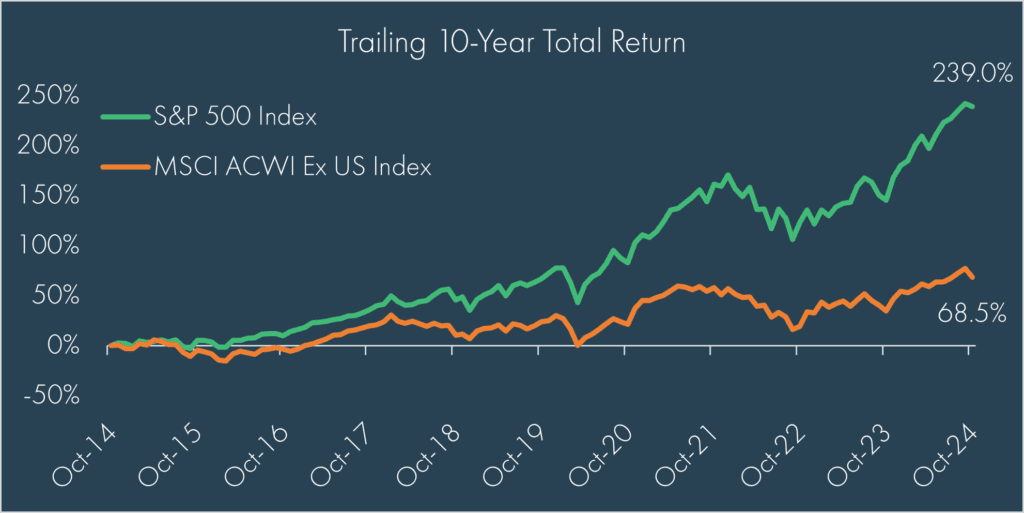

As global investors, mostly living in the US, this naturally leads to the question of “should we put America first in our investments?” The easy answer is “you probably already do”, as US equities make up 65% of global equities as measured by the MSCI ACWI Index. The harder question is “should we allocate even more?”

We have repeatedly emphasized that investing based on who’s president is a losing game – historical data emphatically shows that you are better off staying invested rather than investing only when a Republican or Democrat is in office.

To be sure, the US is the beneficiary of fundamental strengths relative to non-US equities: they have stronger earnings growth and remain the current winners of the AI revolution. As such, markets have rewarded US large cap stocks over non-US stocks, and with Trump’s “America First” campaign this could be a reason investors have pushed US stocks even higher:

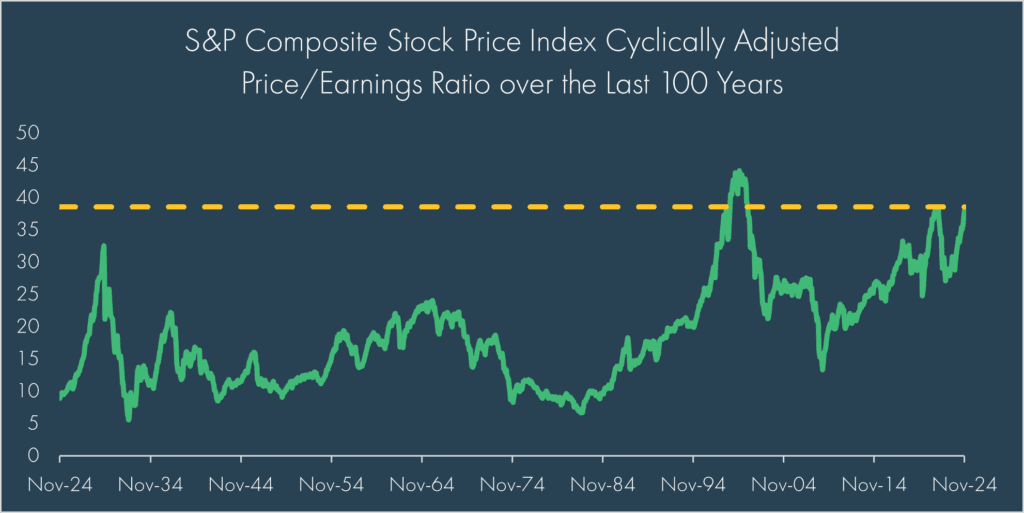

However, emphasizing “US first” now runs counter to the idea that price matters, as US stocks look very expensive by some measures. There are many ways to measure whether something is expensive or not, but a renowned measure is Shiller’s CAPE ratio, a price-to-earnings ratio that adjusts earnings for inflation over the previous decade. As seen in the chart below, the S&P 500 is quickly approaching the level set in 2021, which was only surpassed by the Tech bubble in 2000:

Gravity alone doesn’t pull stocks lower and markets can often “stay irrational longer than one can stay solvent”[2]. However, the price you pay for stocks does matter and should be considered before making changes to your portfolio allocation.

We are not in the get rich quick business. We take a long-term approach that is tailored to each client’s specific needs. There are pros and cons to both US stocks and non-US stocks; that is the risk-reward nature of investing.

You may have noticed in the first chart above that one year after Trump was elected in 2016, the best performing equity asset class was Emerging Markets. Who would have thought when tariffs and geopolitics were a top concern, much like today?

Overall, we are still in the early days of assessing the impact of the election results and will continue to monitor how events unfold. Stay tuned.

[1] https://dogecoin.com/

[2] Attributed to economist John Maynard Keynes

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.

DEFINITIONS

The S&P 500 Index is a free-float capitalization-weighted index of the prices of approximately 500 large-cap common stocks actively traded in the United States.

The Russell 2000® Index is an index of 2000 issues representative of the U.S. small capitalization securities market.

The MSCI EAFE Index is a free float-adjusted market capitalization index designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. With 2,094 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The data and CAPE Ratio was developed by Robert J. Shiller using various public sources and index data. Neither Robert J. Shiller nor any affiliates or consultants, are registered investment advisers and do not guarantee the accuracy or completeness of the CAPE Ratio, or any data or methodology either included therein or upon which it is based.