[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Senior Advisor, Benjamin Trujillo J.D., LL.M. –

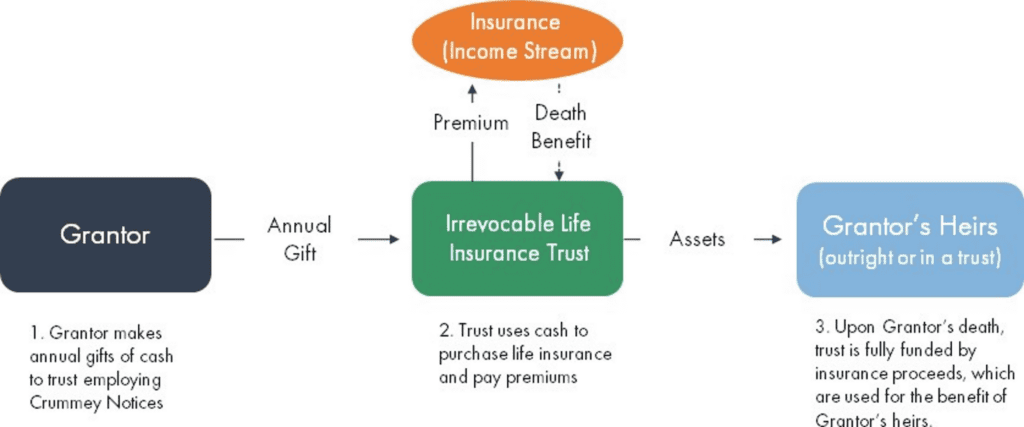

An irrevocable life insurance trust (ILIT) is a trust that is designed to hold a life insurance policy to take care of the trust’s beneficiaries. These trusts were quite popular until the late 2000’s. As interest rates dropped to historic lows after the great recession and equities markets outperformed most other investments, insurance was often viewed less as an investment opportunity and more as a hedge against unexpected loss. There were exceptions to this, especially in the arena of Premium Financing, but in general, ILITs have been in decline for almost 15 years. As we continue to navigate market volatility and rapidly increasing interest rates in recent years, it may be time for ILITs to make a comeback, as they may offer a number of advantages that can potentially help protect assets and provide financial security for loved ones.

An ILITs death benefit can be immune to market fluctuations –

As interest rates increase, insurance policies become more attractive. If the policy in the ILIT has a set death benefit, market fluctuations will not impact the ultimate payout. When the policy is held in the trust, it can provide much-needed stability and security for the trust’s beneficiaries, especially in uncertain economic times.

ILITs cannot be seized to cover outstanding debts –

Another advantage of ILITs is that they can help protect the policy from creditors. Because the trust is irrevocable, the policy cannot be seized by creditors to satisfy outstanding debts. This can be especially important in a down market, when individuals and businesses may be more vulnerable to financial challenges.

ILITs can be structured to provide a tax benefit –

In addition to protecting the policy from creditors, ILITs also have the ability to provide significant tax advantages. In general, the death benefit of a life insurance policy is not subject to income tax, though it may be subject to estate tax. However, if the policy is held in a properly structured ILIT, the proceeds will be exempt from estate and gift tax, providing a significant financial benefit to your heirs.

ILITs help provide liquidity –

Another reason that ILITs are favorable in a down market is that they can provide liquidity to the trust. Because the policy is held in the trust, the proceeds can be used to pay for expenses or distributed to beneficiaries without going through the probate process. Borrowing against the cash value of the policy is another option that can provide much-needed cash flow during difficult economic times.

Overall, irrevocable life insurance trusts can be an effective way to protect assets and provide financial security for loved ones, especially in a down market. Trusts help protect the policy from creditors, can provide tax advantages, and provide liquidity to beneficiaries. The policy can also be structured so the death benefit can be immune to market fluctuations. For these reasons, they are an increasingly popular estate planning tool. After almost 15 years of decline, it might be time we start seeing ILITs gain popularity once again.

If you would like more information, feel free to contact me at 314-735-9106 or at btrujillo@monetagroup.com.

Sign-up to receive these educational pieces straight to your inbox here.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.