Family Office Strategist – Elizabeth Sheehan, J.D.

Estate planning is a complicated process filled with legal terms that can be overwhelming. Developing some familiarity with the various documents and roles typically involved in a straightforward estate plan may make the topic easier to understand. In the following paragraphs, we outline some of the standard legal documents involved in an estate plan, as well as some of the roles those documents include. We also identify some considerations and decisions you may need to make along the way.

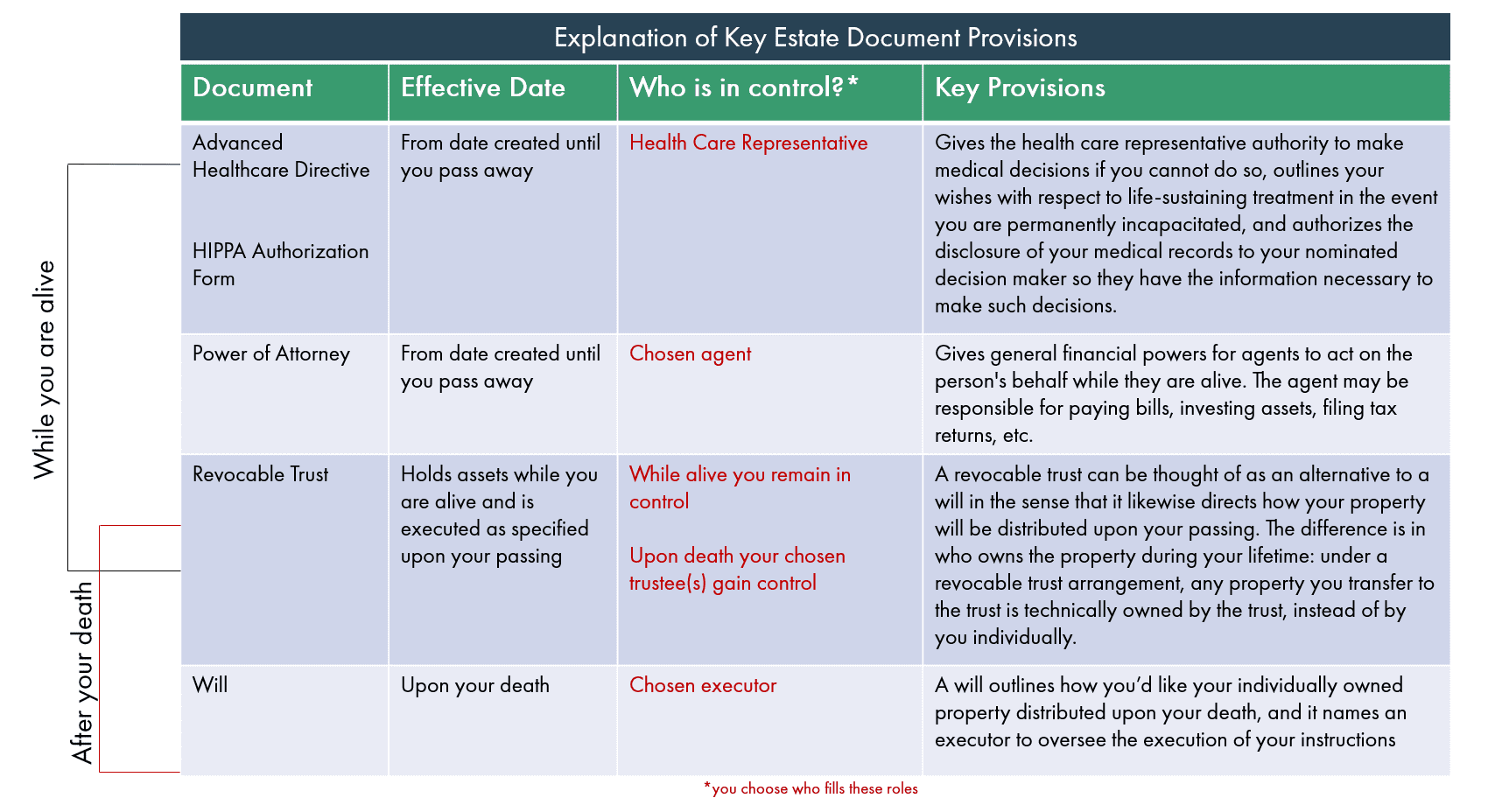

Wills –

A will outlines how you’d like your individually owned property distributed upon your death, and it names an executor, or personal representative, to oversee the execution of your instructions.

- If you hold any property jointly—e.g., with a spouse—it typically passes automatically to the surviving joint holder, depending upon the ownership

arrangement. For example, property held as joint tenants with rights of survivorship will pass automatically to the survivor, whereas tenants in common may not.

arrangement. For example, property held as joint tenants with rights of survivorship will pass automatically to the survivor, whereas tenants in common may not. - Any assets for which you’ve named a beneficiary—retirement benefits, life insurance, etc.—will pass to those beneficiaries.

- Accordingly, your will does not give instructions for the distribution of assets jointly held or for which

- beneficiaries are otherwise named. Reviewing how your assets are titled—i.e., who is considered the legal owner—can ensure your assets will pass to your intended heirs or beneficiaries.

The role: The executor is who you appoint to wrap up your affairs after you pass away. Some states refer to this role as the personal representative. The executor is formally appointed by the court when your will is admitted to probate after your death. An executor’s responsibilities may include paying any remaining debts you leave behind, collecting assets, filing any necessary tax returns, and distributing your property in accordance with the terms of your will.

Decision points/considerations: In composing a will, you should take into consideration any existing legal designations you’ve made—e.g., life insurance or retirement account beneficiaries, established trusts, etc.—to ensure your will and those arrangements are consistent. Generally, spouses name each other as executor, and it is generally advisable to name at least one back-up (often called a successor), in the event your spouse cannot act. You may name one executor to serve at a time, or you may name multiple co-executors.

Trusts –

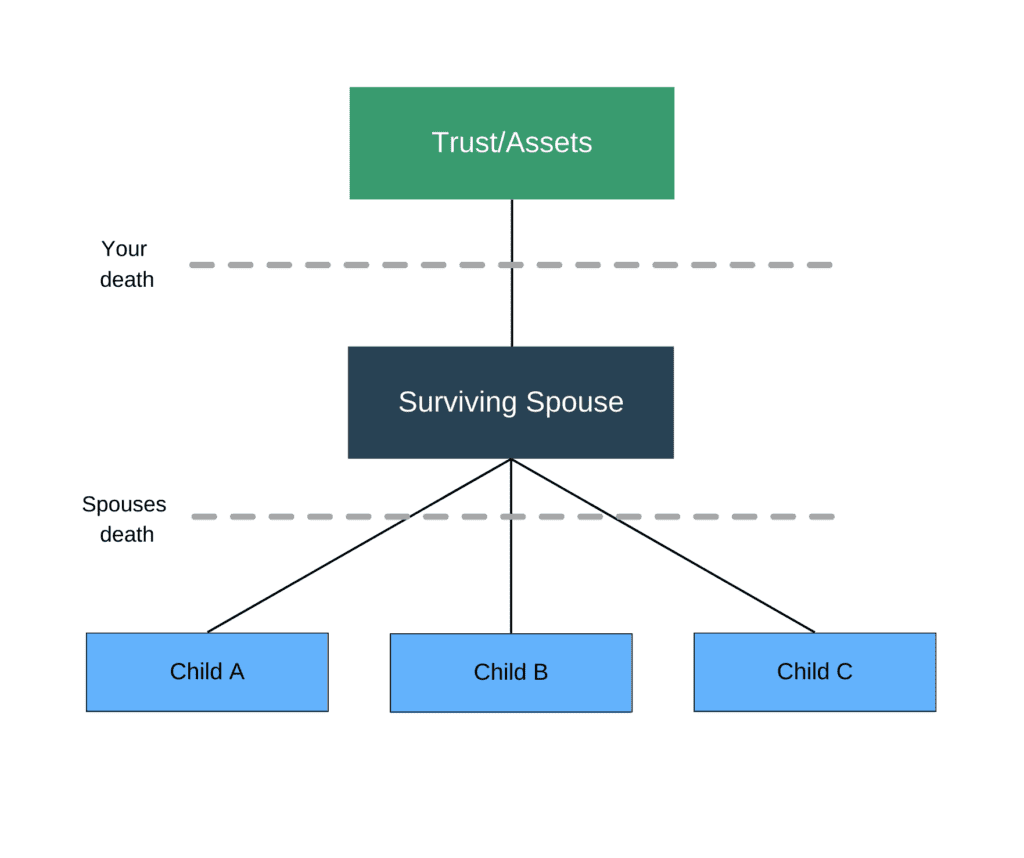

A revocable trust can be thought of as an alternative to a will in the sense that it also directs how your property will be distributed upon your passing. However, a critical difference is in who owns the property during your lifetime: Under a revocable trust arrangement, any property you transfer to the trust is technically owned by the trust, instead of by you individually. For example, if Jane Doe’s revocable trust owns her house, her deed will indicate the property owner is the Jane Doe Revocable Trust. As trustee of her own trust, Jane will still have control over the home’s ownership during her lifetime—and upon her passing, her successor trustee will oversee the house’s proper disposal (transfer to a family member, sale and proceeds distributed among heirs, etc.) according to the trust’s terms.

- Why set up your estate in this way? Transferring ownership of your property to a revocable trust may help you avoid the probate process for those assets. Probate can be a costly, lengthy process involving legal and court proceedings, and can delay the transfer of your assets to your intended

beneficiaries.

beneficiaries. - Establishing a revocable trust can also simplify the handling of any out-of-state real property—e.g., a second home—you acquire, assuming you title the second home in the trust’s name. Such an arrangement may help avoid additional probate proceedings in the additional state(s) which, as we mentioned earlier, can be lengthy and expensive.

- Consolidating the ownership of your real property under a revocable trust can also simplify your estate’s management should you become incapacitated before you pass away.

- Importantly, there are no income tax consequences of re-titling property in the name of your revocable trust. However, you should consult with your attorney before transferring any real estate into your trust to ensure that there are not local property tax implications.

The role: Trustees are responsible for the ongoing management of trust property. Responsibilities may include investing trust property, communicating with trust beneficiaries, making distributions to, or for the benefit of, trust beneficiaries, and filing any necessary tax returns.

- You may be the initial trustee of your revocable trust, giving you complete control over any property transferred to the trust during your lifetime.

Decision points/considerations: Generally, spouses name each other as successor trustee, allowing your spouse to manage trust property for your benefit in the event you are incapacitated. It is advisable to name at least one successor trustee, and co-trustees are permitted.

Advanced Healthcare Directive –

An advanced health care directive (or healthcare power of attorney) is a legal document where you appoint someone to make medical decisions if you cannot do so and outlines your wishes with respect to life-sustaining treatment in the event you are permanently incapacitated. A HIPAA authorization form authorizes the disclosure of your medical records to your nominated decision-maker(s) so they have the information necessary to make such decisions.

The role: A health care representative is responsible for making medical decisions on your behalf in the event you lack the capacity to make those decisions.

Decision points/considerations: Spouses usually name each other, but that is not required, and it is advisable to name at least one successor. Multiple health care representatives may be appointed to serve at the same time, but it can delay any required decision-making and be difficult for medical staff. A better course of action would be to name one individual to serve as a health care representative at a time and you may direct that your children consult with one another, for example. As health care-related decisions can be emotional and complex, we recommend discussing your desires with the individuals you are considering naming to ensure they are comfortable with the responsibilities.

Power of Attorney –

A power of attorney is the document, designed to be used in case you are incapacitated, whereby you give someone you trust various financial powers and authority with respect to your assets.

The role: The agent is responsible for managing your financial affairs while you are living but incapacitated. The agent may be responsible for paying bills, investing assets, filing tax returns, etc.

Decision points/considerations: Although having property managed by your trustee is more administratively convenient if you are incapacitated, it is also advisable to have fully executed powers of attorney and to give your agent the power to transfer property to your trust and to manage any assets that cannot be owned in trust until your death such as life insurance policies and retirement accounts. Like the other roles, your spouse is usually the initial agent, followed by at least one successor. Co-agents are permitted and can either be appointed to make decisions together or separately, based on who is available at the time a decision must be made.

Estate planning is a critical part of your financial plan—though too often people will put it off or, worse, neglect it altogether. Tackling this task together with the right suite of professionals will help ensure your wishes are communicated and legally enforceable once you are no longer able to make such decisions—making it a task worth taking on, particularly with the help of seasoned advisors able to provide guidance to you.

If you would like to learn more, please contact me at 314-244-3453 or at esheehan@monetagroup.com.

To learn more about the complexities of estate planning, check out our first CWCJ Insider series – Estate Planning Insider here.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.