Aoifinn Devitt – Chief Global Market Strategist

It feels like the end of an era – in many ways. Firstly, we may have seen the end of global central bank convergence. Just as the Bank of Japan signaled an end to its NIRP (negative interest rate policy) by hiking rates for the first time in 17 years, other central banks took a different route. The move was based on strong wage growth there, a sign that maybe inflation was finally starting to be resurrected after decades of being dormant.

Other central banks took a different tack, the US Fed held rates steady at 5.25-5.5% as did the Bank of England, while the Swiss National Bank moved its rates down to 1.5% in a surprise move.

The other “end of an era” shift was the rhetoric of the US Fed – they now consider rates to be “restrictive” and this was the justification behind a signal of three rate cuts within 2024. This unanimous decision, paired with a statement that barely changed from the previous meeting, chipped away at some of the uncertainty. While the Fed is not 100% there yet, it does appear to be confident in the direction of inflation – although they did note that it remained “bumpy”.

The commitment to approach rate cuts “carefully” seemed measured but still dovish and it cheered markets, which rose to fresh highs in the US. Overall, this reflects a giddy mood this week, despite an initial jitter around AI at the beginning. The pricing of the Reddit IPO near the top of its range was a pretty enthusiastic reception for a social media platform that has not yet turned a profit. The good times continue to roll.

Interestingly, investors had originally expected less largesse from the Fed – expectations were hovering between 2 and 3 cuts in 2024, and the Fed’s unexpected dovishness led some to fear a new era of “inflation recklessness”. This concern lies in the fact that inflation still shows those bumps that the Fed noted, oil prices had bounced back to a four-month high, which will soon feature again in pump prices. Markets continue to run up, unemployment is still low (Chairman Powell cited it as being “in good shape” and without “cracks”), and economic data is still strong. Evidence of this is that the housing market has already started to move based on lower expected rates it seems – existing home sales rose 9.5% in February, the highest level since February of 2023, although are still down year- over-year (-3.3%).

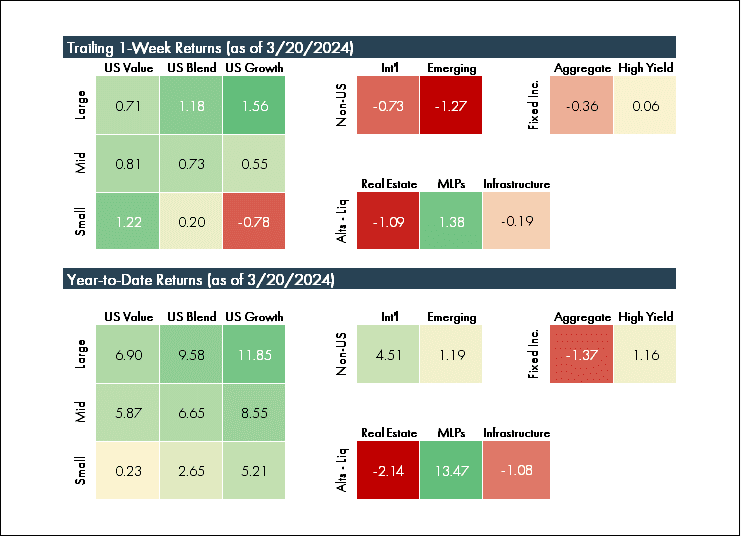

As we approach the end of the first quarter, it has been a strong start to the year, with stars seemingly aligned to move confidently past the “soft landing” so smoothly executed. Spring is indeed in the air, and in market’s step.

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.