Tax Planning

-

Early Steps to Simplify Filing and Align Your Tax Strategy Tax season just began January 27th, but starting early can help streamline the process and reduce stress when deadlines approach. By organizing your financial information…

-

Share Wealth and Save on Taxes this Holiday Season The holiday season is a time for giving, and for those who wish to share their wealth, there are financially efficient strategies that help you give…

-

Welcome to this month’s Ask the CFP®! Today we are going to be discussing Electric Vehicle Tax Credits. Electric vehicles are revolutionizing the way we drive and helping to reduce our carbon footprint. An EV…

-

Senior Tax Strategist – Abby Donnellan, CPA Are you a senior homeowner in St. Louis City, County, or St. Charles County? All three areas offer property tax relief programs for qualifying seniors*. This blog will…

-

By Michael Torney, CFP, J.D., LL.M. For individuals or couples earning a high income this year, it’s important to determine not only how to allocate your earnings to maximize investments, but also to reduce taxes.…

-

Hello and welcome to this month’s Ask the CFP® segment. This month’s question is, “What is the kiddie tax?” The “kiddie tax” is officially known as the Tax on A Child’s Investment and Other…

-

Senior Tax Strategist – Abby Donnellan CPA The SECURE 2.0 Act of 2022, signed into law on 12/29/2022, builds on the prior SECURE Act of 2019 and focuses on helping Americans save for retirement. Below…

-

A Strong Tax Strategy is Part of a Thoughtful, Comprehensive Financial Plan Tax season is upon us and, while not every financial advisor is a Certified Public Accountant (CPA), that doesn’t mean they can’t be…

-

GETTING OUT OF THE MARKET BECAUSE OF TAXES? Are you thinking about bailing out of stocks because you are worried that the capital gains tax structure might change? Before you hit the sell button, think…

-

Michael Torney, CFP, J.D., LL.M. John D. Rockefeller once said, “I always tried to turn every disaster into an opportunity.” With the stock market down by double digits in 2022, investors have such an opportunity…

-

The Internal Revenue Service (IRS) announced significant increases to retirement plan limits for tax year 2023. These highly anticipated cost-of-living adjustments, which were published on Friday, October 21, 2022 are a small silver lining to…

-

Consider preparing for the upcoming tax season by taking advantage of a few important end-of-year tax strategies. Original article from www.usbank.com HERE We’re now in the final quarter of the year, so why not start…

-

By Maggie Rapplean, CFP®, Senior Advisor, Moneta – Solo entrepreneurs, business owners and professionals often work days, nights and weekends. They may not have time to put together a financial plan that would save a…

-

By Michael Torney, CFP, J.D., LL.M. Despite the stock market’s recent downturn, many people will plan this year to donate money to their favorite nonprofit organizations. But with nearly everyone taking a closer look at all…

-

Erin Hadary MBA, CFP®, CAP® | Partner Real estate can be an excellent investment opportunity for those who want to diversify their portfolio. But capital gains taxes can eat into your proceeds when you sell…

-

Hello everyone and welcome to this month’s Ask the CFP segment. This month’s question is, “How can I avoid the Net Investment Income Tax?” For those not familiar with this tax, the Net Investment Income…

-

Hello everyone and welcome to this month’s Ask the CFP segment. This month’s question is, “What is tax loss harvesting?” Tax loss harvesting, which I’m going to call TLH at the risk of being tongue-tied…

-

Hello everyone and welcome to this month’s Ask the CFP segment. This month’s question is, “What is a Donor-Advised Fund?” A Donor-Advised Fund is a tool that can be used to help facilitate donations to…

-

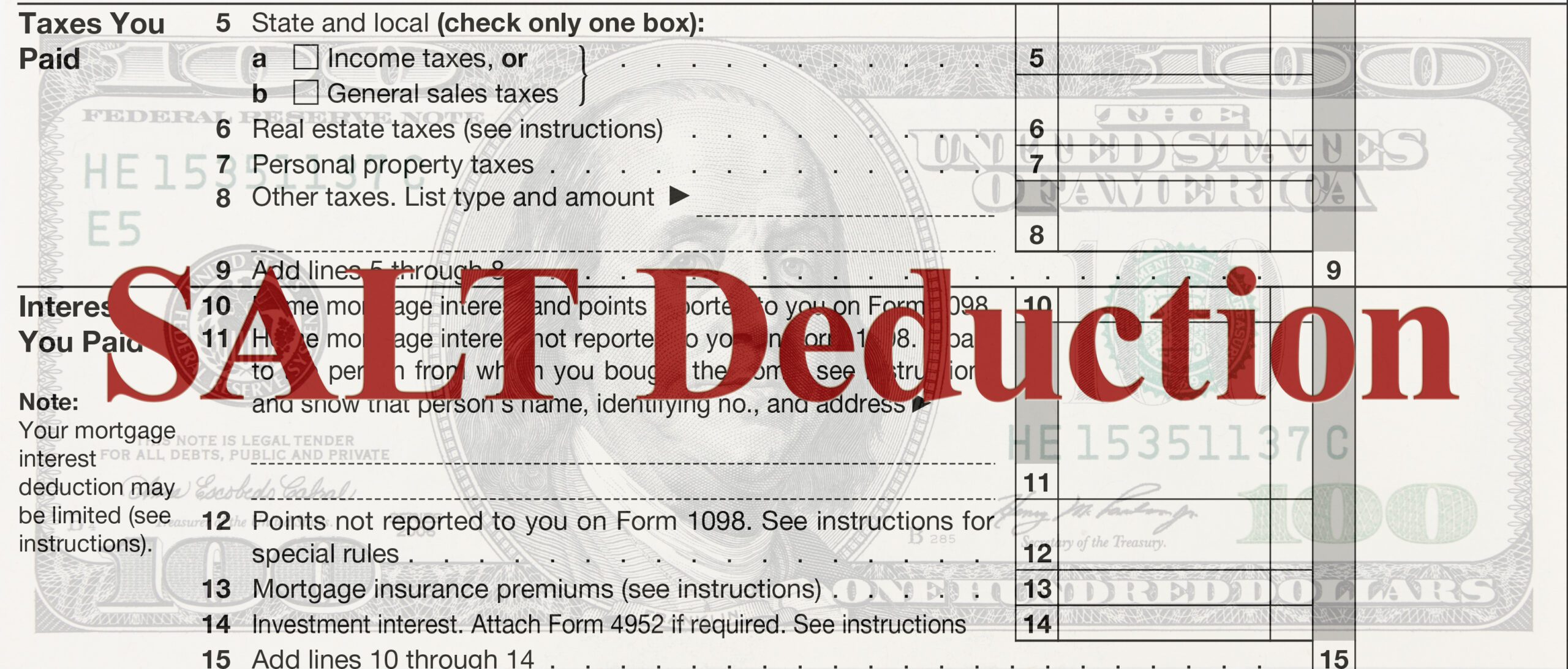

Starting in 2018, the Tax Cuts & Jobs Act limited the State and Local Tax (SALT) deduction on individual taxpayers’ Schedule A – Itemized Deductions to a maximum amount of $10,000. Before 2018, individuals could deduct…

-

High-income and high-net worth individuals should expect a dramatic change in the tax and estate planning landscape.

-

By Benjamin Trujillo, JD, LLM – Senior Advisor and Lauren Randazzo, CPA – Advisor On Sunday, December 27, 2020, President Trump signed the Consolidated Appropriations Act, 2021. The bulk of the provisions within this $2.3 Trillion, 5,000 plus page…

-

2020 has been an unusual year to say the least. As we have adapted to “new normals” throughout our lives, following are some important changes to consider as the year closes for your tax strategy.…

-

By Benjamin Trujillo, JD, LLM – Senior Advisor and Lauren Randazzo, CPA – Advisor The IRS and the Treasury Department recently provided additional guidance which may result in higher taxes for Payroll Protection Program (PPP)…

-

By Benjamin Trujillo, Senior Advisor and Anna McDonald Elections inspire change, and if there is one thing we can expect from 2020, it is change. Nearly every aspect of life has been altered due to…