Investments

-

David Wickenhauser | Investments Strategist As the S&P 500 inches closer to bear market territory, our Investments Strategist David Wickenhauser takes this Moneta Moment to discuss how investors can keep their emotions in check when…

-

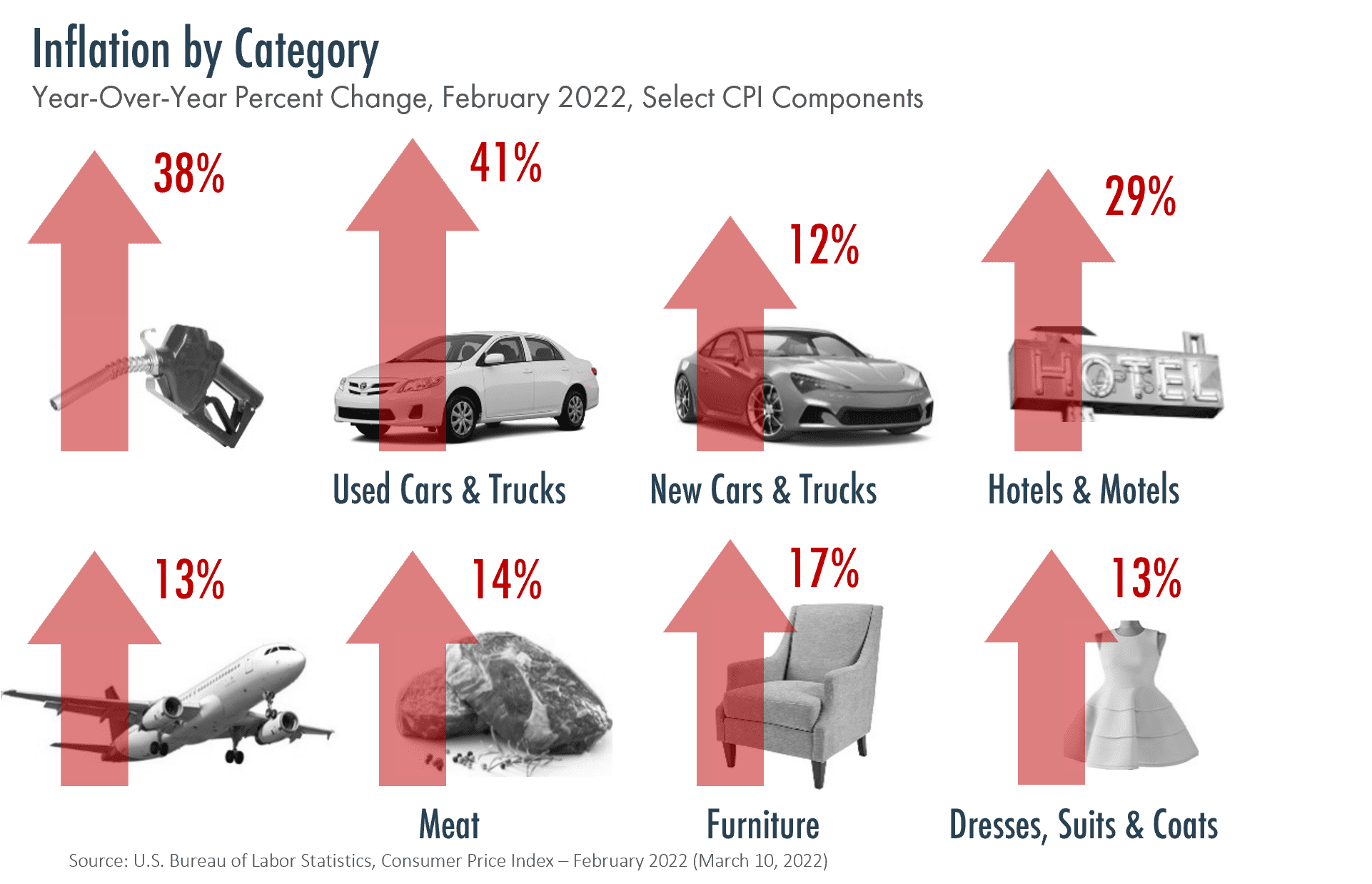

Aoifinn Devitt | Chief Investment Officer Inflation levels have steadily risen to 40-year highs and Moneta Chief Investment Officer, Aoifinn Devitt, is here to discuss what that means for you and your portfolio. Inflation is now…

-

Aoifinn Devitt | Chief Investment Officer As we write, markets are in the middle of a broad-based retreat, and this week started with the worst day in global markets since 2020. While technology and high…

-

Aoifinn Devitt | Chief Investment Officer The war between Russia and Ukraine, historic inflation, rising interest rates and concerns about the economy’s resilience have all contributed to the volatile start in 2022 for equity markets. While…

-

Tim Side | Research Analyst Introduction Recent market events have created a significant amount of uncertainty in global markets. A year that began with concerns over tighter monetary policy amidst rampant inflation has now been…

-

Contributors Quarterly Letter “When you got skin in the game, you stay in the game,but you don’t get a win unless you play in the game.”-Lin-Manuel Miranda, Hamilton Despite recent market volatility and a negative…

-

Aoifinn Devitt | Chief Investment Officer This episode of the Moneta Moneywise Podcast is a robust and packed discussion on topics that are gripping markets today as Moneta’s CIO Aoifinn Devitt shares a conversation with…

-

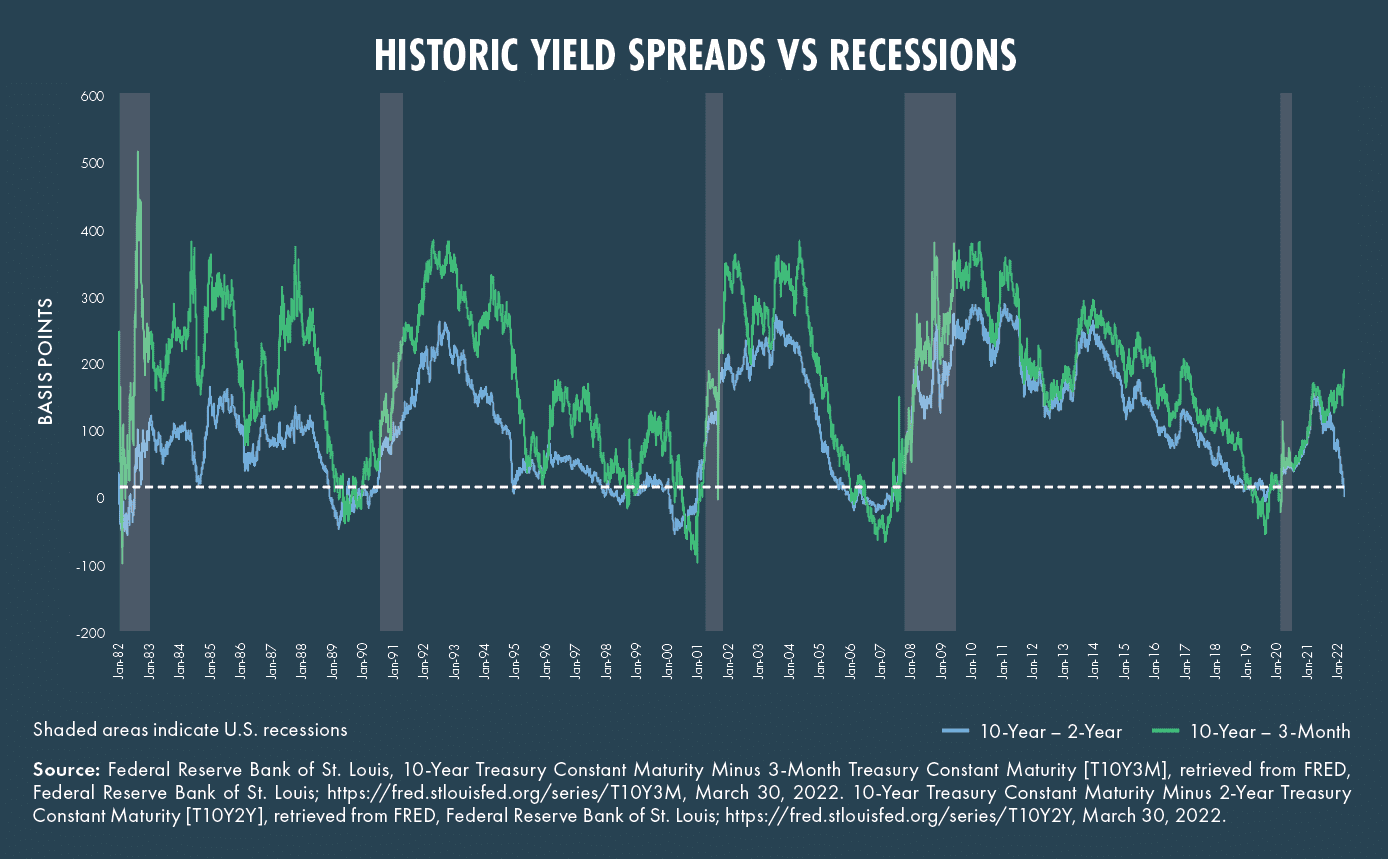

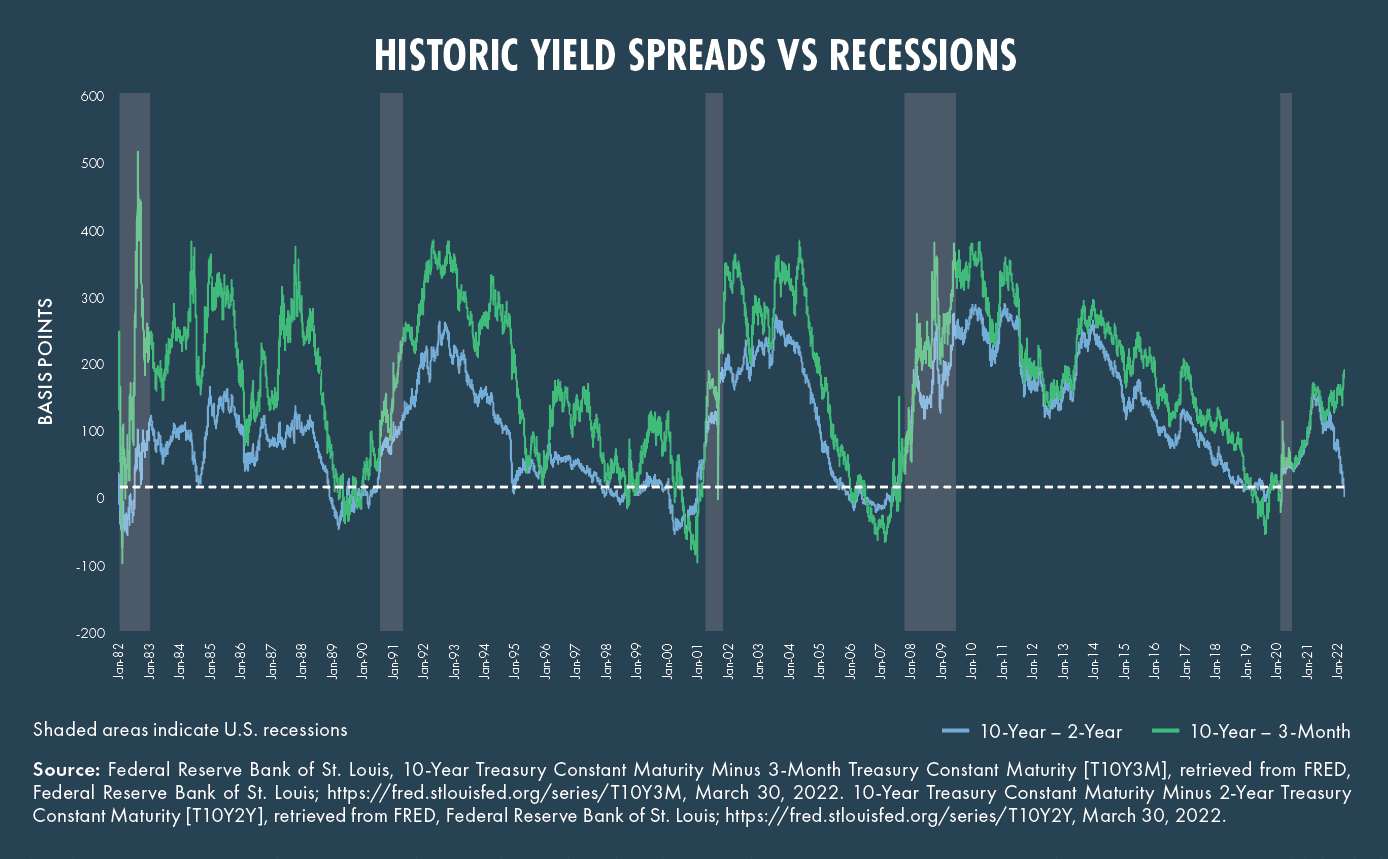

Chris Kamykowski, CFA, CFP® | Head of Investment Strategy and Research Rich McDonald, MBA | Head of Fixed Income and Portfolio Management The first quarter of 2022 provided plenty of fodder for the markets to contend…

-

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.16″ global_colors_info=”{}” da_is_popup=”off” da_exit_intent=”off” da_has_close=”on” da_alt_close=”off” da_dark_close=”off” da_not_modal=”on” da_is_singular=”off” da_with_loader=”off” da_has_shadow=”on” da_disable_devices=”off|off|off”][et_pb_row admin_label=”row” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_text admin_label=”Text” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”] Chris Kamykowski, CFA,…

-

In this edition of the Private Market Report, we review developments throughout 2021 relating to private equity, venture capital, private debt, and real estate. Our Research Spotlight features a high-level history of Private Equity and…

-

Aoifinn Devitt | Chief Investment Officer Chris Kamykowski, CFA, CFP® | Head of Investment Strategy and Research As the Russia/Ukraine situation took a tragic turn overnight, governments are jostling to respond to the most blatant act…

-

Aoifinn Devitt | Chief Investment Officer Chris Kamykowski, CFA, CFP® | Head of Investment Strategy and Research In mid-January, a headline in the Wall Street Journal screamed that “Omicron (had) killed certitude.” The opinion-writer was right;…

-

By Aoifinn Devitt | Chief Investment Officer Highlights The fourth quarter saw new highs in US equity markets as markets continued to display the stubborn resilience that has characterized much of the post-COVID rally. Volatility…

-

By Aoifinn Devitt | Chief Investment Officer Highlights The fourth quarter saw new highs in US equity markets as markets continued to display the stubborn resilience that has characterized much of the post-COVID rally. Volatility…

-

For financial markets, a New Year always brings much to contemplate. How will economic fundamentals play out? How will financial markets react? What obstacles to economic growth might occur, and what, as investors, are we…

-

Market Commentary Stock market returns in 2021 were very strong. U.S. stocks, as measured by the S&P 500 Index, posted another banner year, up 29%. International equities lagged their U.S. counterparts but were still up…

-

Bloomberg interviewed Moneta CIO Aoifinn Devitt on live TV, asking her whether or not the recent slump of the US dollar has made the asset no longer investable. The conversation touched on the impact of…

-

In this edition of the Private Market Report, we review developments throughout 2021 relating to private equity, venture capital, private debt, and real estate. Our Research Spotlight features a high-level history of Private Equity and…

-

Bloomberg interviewed Moneta CIO Aoifinn Devitt about U.S. equities as investors keep an eye on inflation, interest rates and market volatility in the final month of a record year. Devitt noted the propensity of investors…

-

By Grant Edmunds, CFP® – Advisor By now, most investors have heard of China’s second-largest real estate firm, Evergrande Group, and the potential default that looms over China’s vital real estate sector. For decades many have brushed…

-

By Aoifinn Devitt | Chief Investment Officer Highlights The third quarter was dominated by talk of inflation as the September Consumer Price Index (CPI) showed a 5.4% increase from September 2020, representing a 13-year high(1).…

-

Seasoned financial professional will leverage 34 years of industry experience to help build Moneta’s alternative investment platform ST. LOUIS — Oct. 13, 2021 — With evolving client needs a top priority, Moneta, a 100% partner-owned…

-

Seasoned financial professional will leverage 34 years of industry experience to help build Moneta’s alternative investment platform ST. LOUIS — Oct. 13, 2021 — With evolving client needs a top priority, Moneta, a 100% partner-owned…

-

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.22″ global_colors_info=”{}” da_is_popup=”off” da_exit_intent=”off” da_has_close=”on” da_alt_close=”off” da_dark_close=”off” da_not_modal=”on” da_is_singular=”off” da_with_loader=”off” da_has_shadow=”on” da_disable_devices=”off|off|off”][et_pb_row admin_label=”row” _builder_version=”3.25″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”3.25″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_text admin_label=”Text” _builder_version=”3.27.4″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”] Are Special Purpose…