Aoifinn Devitt – Chief Global Market Strategist

Have we now entered the antifragile era for markets? This concept, made popular by Nassim Taleb, loosely means something that benefits from chaos and volatility and is made stronger, not weaker, as a result. As we write, the Dow Jones Industrial Average has just topped 40,000 for the first time – an extraordinary feat in the face of interest rates that remain higher for longer, an employment picture that is starting to weaken (albeit slightly), still elevated levels of inflation and the uncertain fog of an election year.

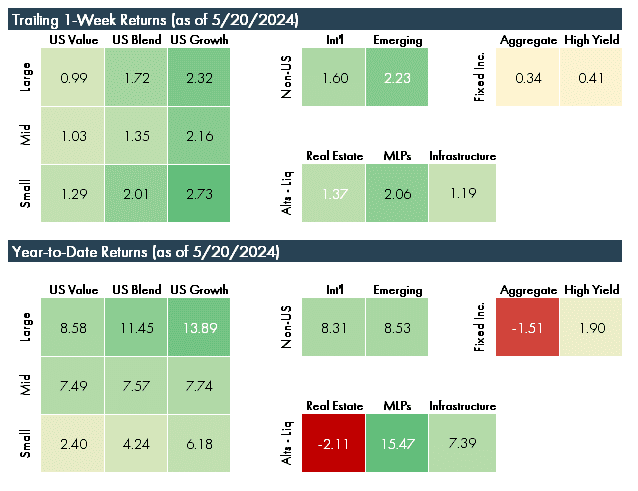

The Dow is now up almost 40% from its September 2022 low – and has doubled in 7 years, when the last time it doubled it took 18 years. This measure has its weaknesses of course – it is only an average of prices and not an index generally used as a benchmark. But it does reflect the breadth of price rises, and as our charts have shown there is a broadening of market strength in recent weeks to include non-US markets as well as lagging styles (value) and cap sectors (small and mid-cap).

So, are markets stronger because of what they have overcome? Not necessarily.

Maybe (to invoke another Taleb-ism), we shouldn’t be “fooled” by the strength of the numbers. A few things have changed the landscape, like the transient but still sticky effect of COVID stimuli, while the AI euphoria around AI still lacks hard modeling and predictive data on the impact of AI tools. That makes it hard for “past performance” to be predictive – and we can’t learn much from the past. So maybe the apparent market strength is still suffering from COVID-era distortions.

We have also seen that there are periods when low conviction takes hold and market jitters are laid bare. The periodic “wobbles” in market sentiment – that have appeared in clusters over the past two years – such as around the regional bank crisis and after spates of earnings announcements – suggest that some investors aren’t entirely comfortable with the disconnect between market strength and on-the-ground pain.

And this “disconnect” or cognitive dissonance continues. Inflation is apparently receding but services inflation and highly visible items like gas at the pump and auto-insurance are continuing to rise.

Rate cut predictions are proving to be a little like shifting sands – currently consensus is coalescing around two cuts this year – up from one or none now that economic conditions are softening. This is leading to some volatility among bonds, which naturally turns the lens back to equity.

The US dollar has been just as unpredictable, with some recent weakness – no doubt providing some relief for trading partners, particularly Japan and Europe who have struggled with dollar strength. Another asset that may not be anti-fragile. Although stranger things have happened.

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.