Aoifinn Devitt – Chief Global Market Strategist

Any readers who love to ski will know that 2024 has been another great ski season in the Western US. Abundant snow, falling somewhat later in the season, has led to some resorts being open “ALAP” – as late as possible, even now into early May. While things looked anemic earlier in the season, a pick-up in snowfall throughout the spring led to the snowpack in Alta ending March at 130% of its median. The US Fed now has a similar open-endedness to its interest rate pause – it too seems likely to leave rates high “ALAP”.

Sticking with the snow analogy – the snow keeps falling – inflation is persistent albeit lighter/lower – but the “snowpack” – akin to the effect of cumulative inflation, seems remarkably resilient. Right now, inflation seems stuck at over 130% of its median (over 3% v. a target of 2%) and Chairman Powell has acknowledged that it is appearing to be a little stickier than previously thought.

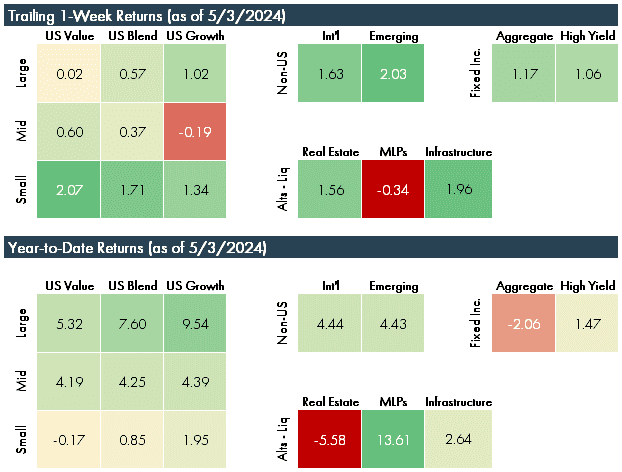

While the Fed was maybe surprised by the stickiness of inflation, in its meeting last week its resolve was unwavering, and this instilled confidence in equity markets after the meeting. Rates gapped out somewhat, reflecting the new “higher for longer” expectation and US Treasuries ended the week at around 4.8%. Markets were equally robust over the course of last week although lost some steam as the weekend neared.

The common thread with the economic data, though, is surprising resilience. Why “surprising”? Because after a sustained rate rise cycle leaving rates at a 23-year high there has been no “landing” or period of contraction. One small sign of this presented Friday as the weakness in job numbers. The announcement that only 175,000 new jobs were added in April was well below expectations, and the slowest monthly job growth since October 2023. Unemployment was also slightly higher at 3.9% and the growth in the price of labor had also become softer – a key indicator that can point to future inflation. Markets are relatively optimistic at this stage – they have realized that Powell poured cold water on the idea of a “reverse pivot”. Despite the unusual conditions, winter doesn’t last forever. It is highly unlikely that the next rate move will be upwards – it just seems that we will be sitting here, level, for longer than previously thought.

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.